how are rsus taxed in the uk

References to or dollars or US dollars are to the legal currency of the US referen. Ah sorry was looking with a UK perspective - the USA really doesnt want the little people accumulating.

RSUs are taxed as income at vest time so if youre granted 100K in RSUs in 2020 and they vest in 2023 come 2023 if the stock has increased 25 to 125K youll be taxed on 125K of income.

. Invests after-tax dollars E. A petition is making the rounds that many sports fans can get behind. Knapp ID card application conditions.

For more information check out this article on how to save tax with bonus sacrifice. You will also pay national insurance at 2. References to India are to the Republic of India.

You may also need to pay for employers national insurance. But any profit that you make above this figure will be taxed at 33 and you will need to file a tax return each year. How to reduce your capital.

This marginal tax rate means that your immediate additional income will be taxed at this rate. RSUs are another way of issuing equity. Initial Director Awards are scheduled to vest on the next February 1 following the grant of the award.

Is the type of account offered by most employers See Section 21. RSUs are taxed as ordinary income as of the date they become fully vested using the fair market value of the shares on the date of vesting. Funds are taxed at the time you begin withdrawals C.

No capital gains involved anywhere. Such payments will generally be taxed as earnings in the year they are received unless the entitlement amounts to a right to acquire securities in which case from 6. Will I get double-taxed on my RSUs.

Michael probably should have. Top of page RSUs that provide cash on vesting. Restricted stock Participants receive beneficial ownership of shares at the outset but the shares are subject to forfeiture on cessation of employment or on failure to meet performance targets at the end of a performance period of at least three years.

The UK tax treatment for RSUs is similar to how your salary is taxed. Walshemj 17 hours ago root parent next. A brokerage account in which purchases can be made using credit is referred to as which type of account.

This taxable value is called perquisite value and is taxed under the head Income from Salaries. When your RSUs vest you will pay income tax and employee national insurance. You are granted RSUs and they vest in a given year.

Per our SAFE framework we do not add specific dates to the handbook. Approved attestors when applying for an ID card. You do not get double-taxed on RSUs although taxation may occur at more than one point in time.

If the continuing business is taxed as a partnership eg an LLC with multiple owners then the sale of LLC equity by rollover participants will generally be entitled to capital gains treatment. 000 is the 25th percentile. The salary you make out of college can define your career.

How to apply for an ID card. Like other options schemes RSUs can be conditional and are subject to a vesting schedule. UK citizen with residence status.

Walshemj 10 hours ago root parent next. What is a restricted stock award. Are well-suited to investors nearing retirement D.

Table of Contents. VQS a global provider of secure AI-driven digital voice and video capture technology. Employers have the discretion to.

VIQ or the Company TSX and Nasdaq. Electronic identification with the ID card. References to China are to the Peoples Republic of China.

Im from a third-world developing country and a 5-figure dollar salary is upper-middle class range already. Information Technology IT Services - Salary - Get a free salary comparison based on job title skills experience and education. If you have a residence permit.

Knapp Living in Sweden. They can be structured rather like options but shareholders are taxed when the shares vest. You can save tax and national insurance by sacrificing your bonus into your pension.

My salary is 000 and Im 23 and single. If you make a disposal between 1 January and 30 November you. Mid-sized co in Texas Software engineer k salary k RSUs vesting over 4 2015 - 80000 year - Technical Lead remote job.

The million Pokimane Twitch donation. For example if you earn 100000 and receive a bonus of 12000 the bonus will be taxed at 60. No capital gains involved anywhere.

Average Salary and Wage in the UK. The general mechanics of RSU compensation are this. References to UK are to the United Kingdom.

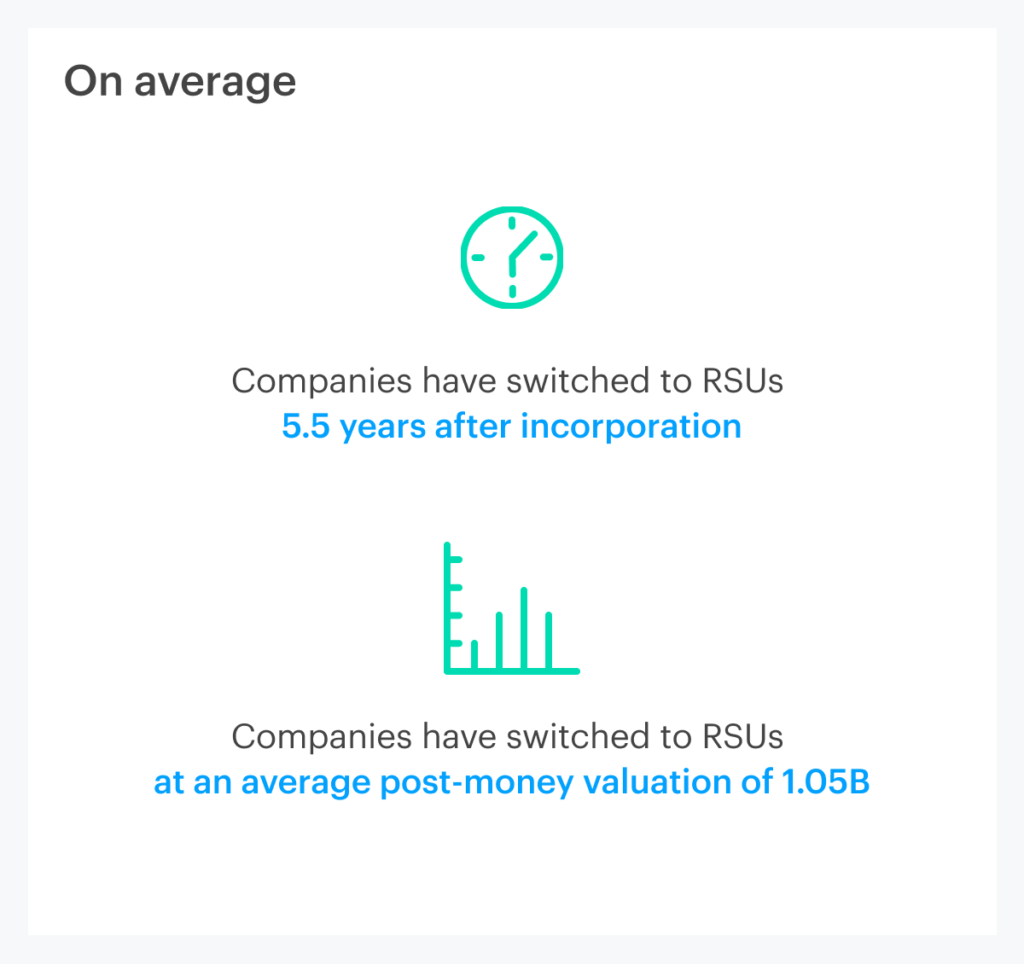

If you are self-employed you can include your CGT liability on your Form 11. VIQ Solutions Inc. RSUs are the industry standard for broad-based grants in firms past the startup stage.

Employee owned trusts own controlling stakes in businesses on behalf of employees. Ah sorry was looking with a UK perspective - the USA really doesnt want the little people accumulating. In that year you will see them show up on box 14 of your W2 with a code of RSU You may also see.

Stock options become less effective as a company gets larger and the transition to RSUs is a normal step in the growth path in order to optimize our equity plans for our team members. References to South Africa are to the Republic of South Africa. Filing an 83b election allows you to pay taxes early when company shares are granted instead of upon vesting which could minimize your tax burden.

The number of RSUs subject to each Initial Director Award is determined in the same manner as described above for Annual Director Awards but the award is pro-rated based on the portion of the period that has passed since the last annual meeting. Created November 10th 2011 This UK salary guide will teach you everything you need to know so you can Mixx Facebook Twitter Digg delicious reddit MySpace. They were introduced in 2014 as an.

References to EU are to the European Union. Receiving the finished ID card. Weve identified six states where the typical.

The employer is required to withhold taxes as soon as the RSUs become vested. RSU Vesting Grant Cadence. Approved ID documents when applying for an ID card.

In a previous post Restricted Stock Units RSU Tax Withholding Choices I wrote about what I chose among. So RSUs which do confer upon the recipient a right to acquire securities - see ERSM110500 will be taxed under Chapter 5. Here since the RSUs do not have an exercise price the fair market value of the RSUs shall be fully taxable as perquisite.

What are the job opportunities after Red Hat RHCSA certification. RSUs are taxed as income at vest time so if youre granted 100K in RSUs in 2020 and they vest in 2023 come 2023 if the stock has increased 25 to 125K youll be taxed on 125K of income. The biggest difference between RSUs and employee stock options is that RSUs are taxed at the time of vesting while stock options are usually taxed at the time of option exercise.

UK participants can elect to pay income tax on the value of the shares at the outset. It shall be noted that in the event the employer provides the compensation in the form of cash equivalent to the. If you had income from stock comp in 2018 and taxes were withheld heres what you need to know to decipher your Form W-2 before you complete.

What really happenedOct 31 2018 2013. The tax reporting for stock compensation is confusing.

Switching From Options To Rsus Carta

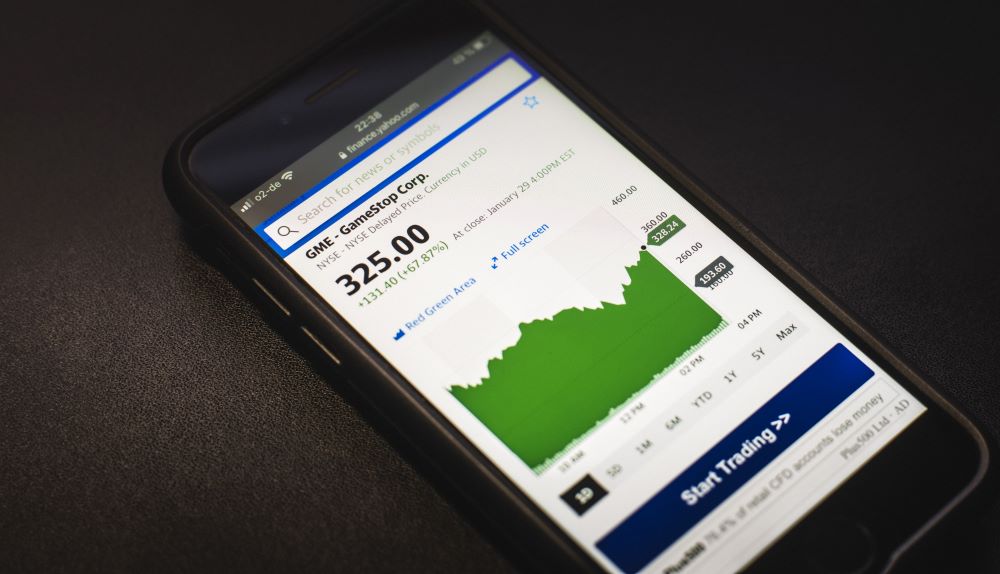

What Is A Restricted Stock Unit Robinhood

Which Is Better Stock Options Or Rsus All You Need To Know Stock Options Staging Companies Options

New Irs Cost Basis Reporting Rules Pdf Free Download Irs Dividend Reinvestment Plan Tax Guide

Stock Options Vs Restricted Stock Units Rsus Diligent Equity

Scrolling By Max Kalik Web App Design App Interface Reading Process